- Published on August 19, 2025

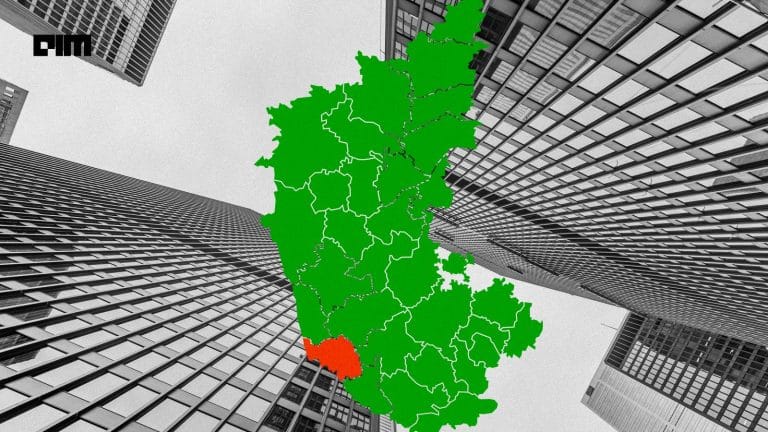

- In GCC

NatWest takes its AI engagement further with OpenAI Deal

📣 Want to advertise in AIM? Book here

Vendors mislabel copilots as agents, raising regulatory and operational risks for firms chasing the promise of agentic AI.

Unlike other providers focused on GPU allocation, Neysa claims to deliver an end-to-end AI cloud platform.

In a live demonstration for AIM, Posha prepared paneer tikka masala in approximately 25 minutes

“Knowledge-driven components are important because we don’t want everything to be just algorithmic innovation.”

As businesses recognise the potential of voice-driven tech, Pradhi AI is laying the foundation for an empathetic, responsive AI ecosystem.

“The coastal city could showcase tangible results by applying deep tech to areas it already dominates”

The company’s new AI image and photo editor deepens concerns over data use and consent gaps, experts warn.

The consortium insists sovereignty doesn’t mean shutting the door on global players.